The Modern Brokerage

for Financial Institutions

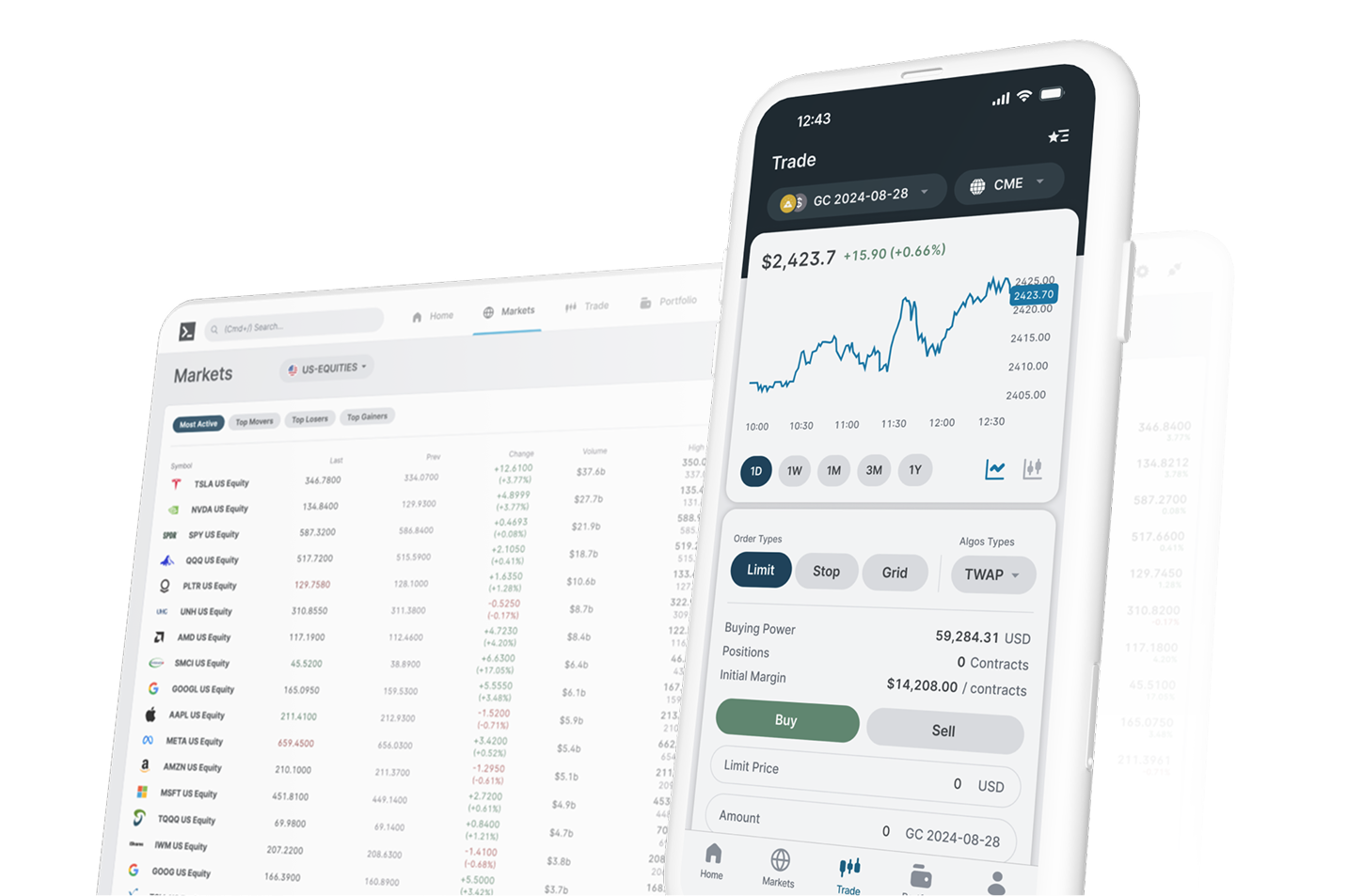

Access US equities, regulated derivatives, and event contracts through a integrated platform powered by advanced execution technology.

Advanced Analytics

- -Live and historical candles

- -Full depth, level 2 order books

- -Real-time positions and P&L

- -Cross-asset margin information

- -Algo execution quality statistics

Advanced Order Types

- -Stop-loss, take-profit orders

- -Iceberg orders

- -Click-trading price ladder interface

- -Exchange-supported time-in-force instructions

Execution Algorithms

- -TWAP/VWAP/Percent-of-volume

- -Auto-spreader

- -Market-making algos

- -Out-of-the-box algos via UI and API

- -Rest-and-chase for limiting spread-crossing

Flexible APIs

- -REST, Websocket, gRPC

- -SDKs in Python, Typescript, and Rust

- -Full order lifecycle

- -Marketdata, positions, P&L, & margin

- -Create custom algos ...

Trade Everything in One Place

Trade multiple asset classes with professional tools designed for sophisticated market participants seeking precision, speed, and capital efficiency.

Open Brokerage Account →

Equities and ETFs

Execute in thousands of stocks and ETFs. Access advanced order types with institutional-grade routing and execution quality.

Learn more

Options

Real-time options analytics and high-power trading tools enable smart hedging and bold positioning in all market environments.

Learn more

Futures

Trade the complete suite of CME-listed derivatives. Leverage execution algorithms and optimize your derivatives strategies.

Learn morePowerful Brokerage Trading

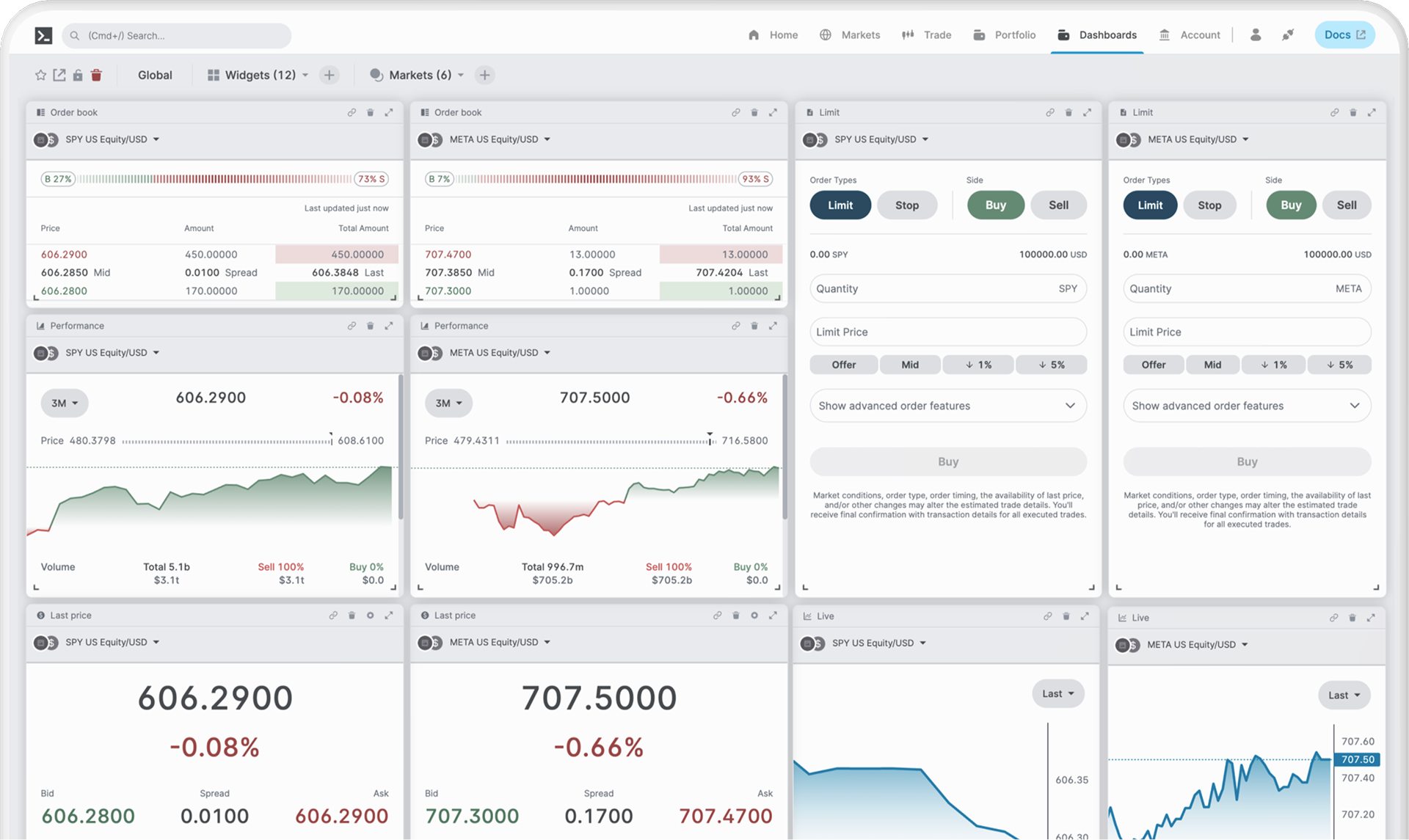

Dashboards

Quickly build dashboards that fit your trading style and strategy, choose from a library of widgets and select markets you trade.

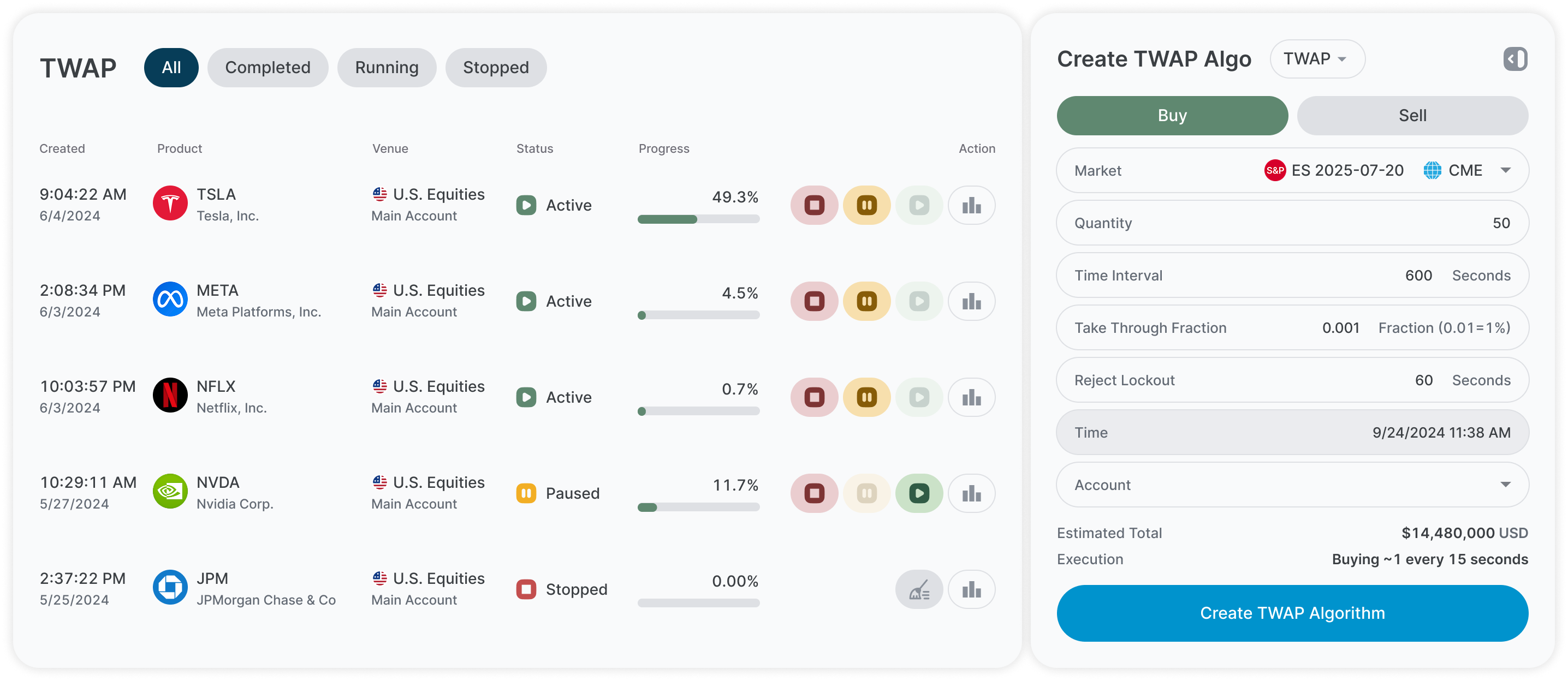

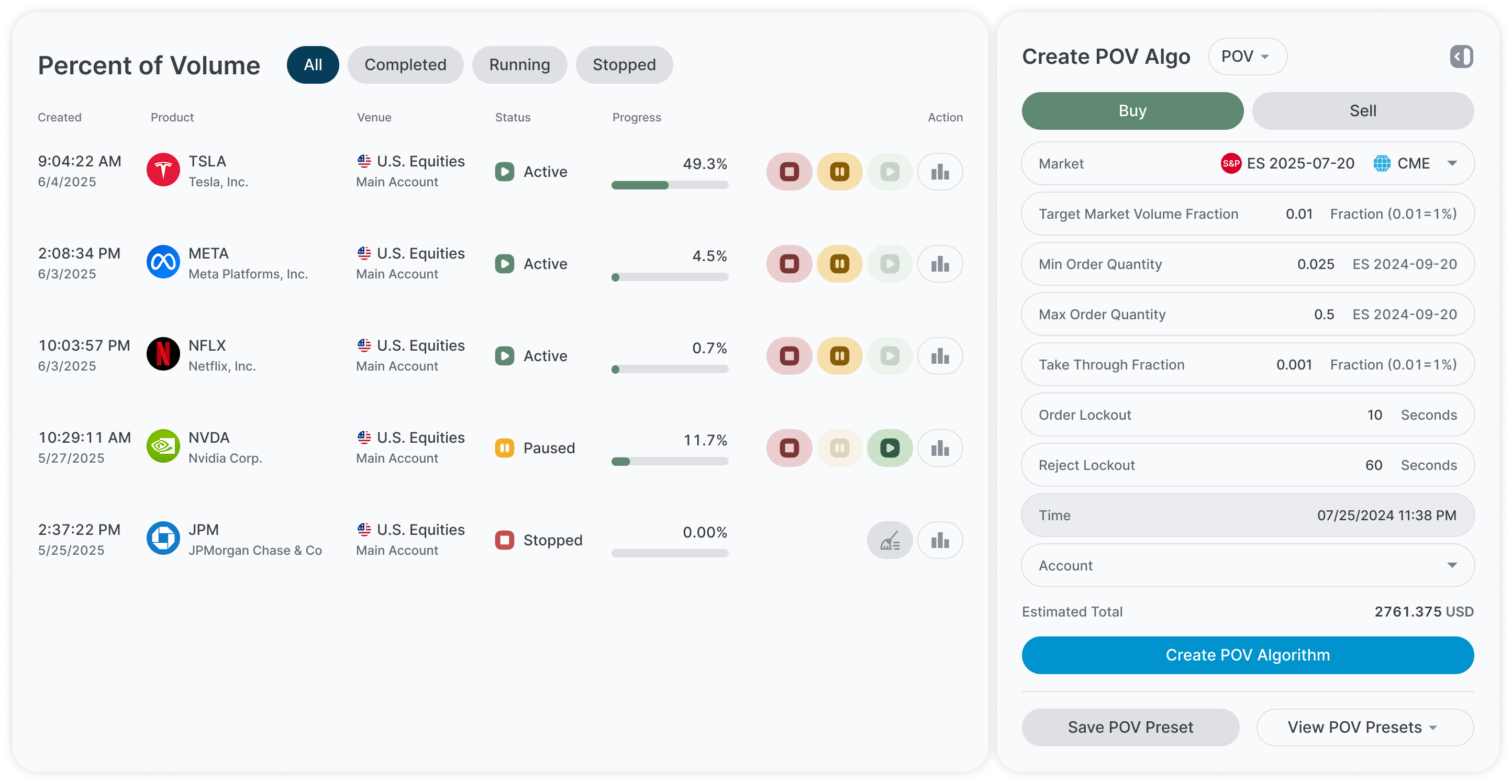

Algos

Built-in institutional-grade algos to achieve better execution quality. The Time-Weighted Average Price (TWAP) algo attempts to spread out an order evenly throughout a period of time. Using a TWAP execution is one way to achieve an average price that matches the market and can help minimize slippage and reduce costs.

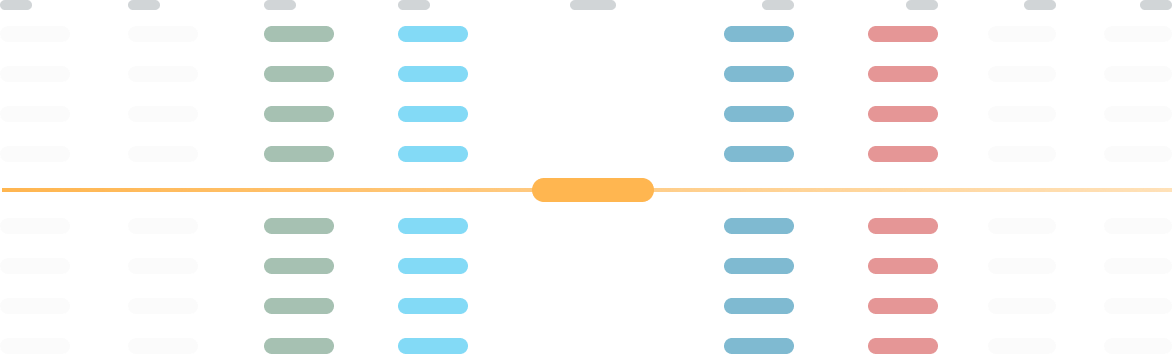

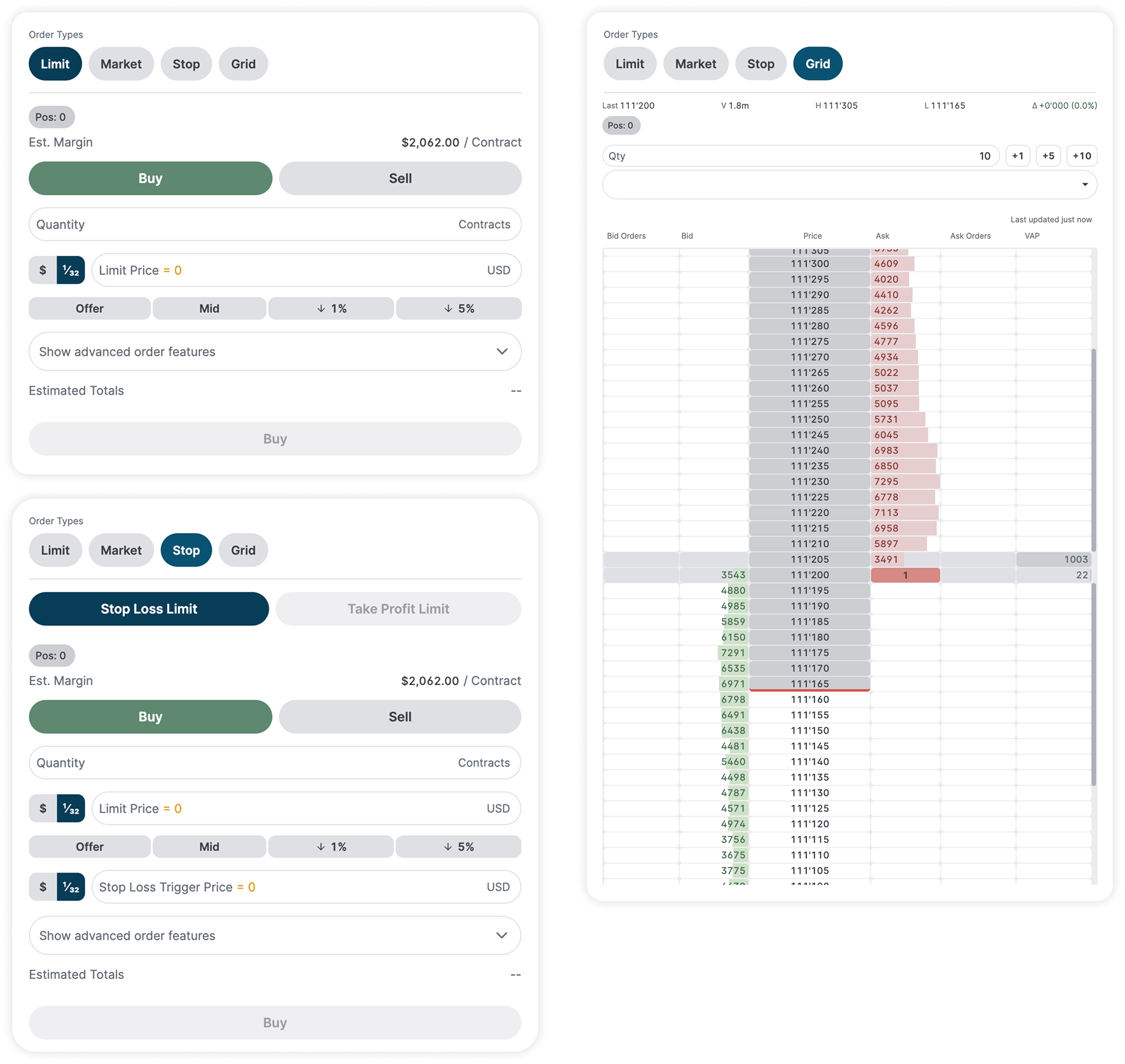

Order Types

Advanced Order Types: Use our Stop Loss and Take Profit order types to have more control over your trading strategies. Send orders quickly and efficiently using our Grid interface.

APIMulti-language API access

Develop execution algorithms, stream market data, access positions and P&L and more using our versatile, multi-language APIs.