Brokerage

Institutional Speed

The Modern Brokerage

for Financial Institutions

Access US equities, regulated derivatives, and event contracts through a integrated platform powered by advanced execution technology.

Advanced Analytics

Live and historical candles

Full depth, level 2 order books

Real-time positions and P&L

Cross-asset margin information

Algo execution quality statistics

Advanced Order Types

Stop-loss, take-profit orders

Iceberg orders

Click-trading price ladder interface

Exchange-supported time-in-force

instructions

Execution Algorithms

TWAP/VWAP/Percent-of-volume

Auto-spreader

Market-making algos

Out-of-the-box algos via UI and API

Rest-and-chase for limiting

spread-crossing

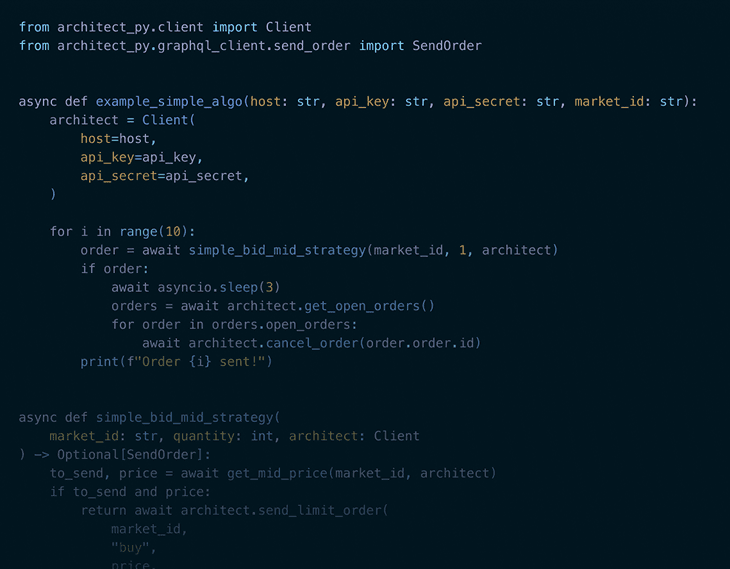

Flexible APIs

REST, Websocket, gRPC

SDKs in Python, Typescript, and Rust

Full order lifecycle

Marketdata, positions, P&L, & margin

Create custom algos ...

Trade Everything in One Place

Trade multiple asset classes with professional tools designed for sophisticated market participants seeking precision, speed, and capital efficiency.

Equities and ETFs

Execute in thousands of stocks and ETFs. Access advanced order types with institutional-grade routing and execution quality.

Options

Real-time options analytics and high-power trading tools enable smart hedging and bold positioning in all market environments.

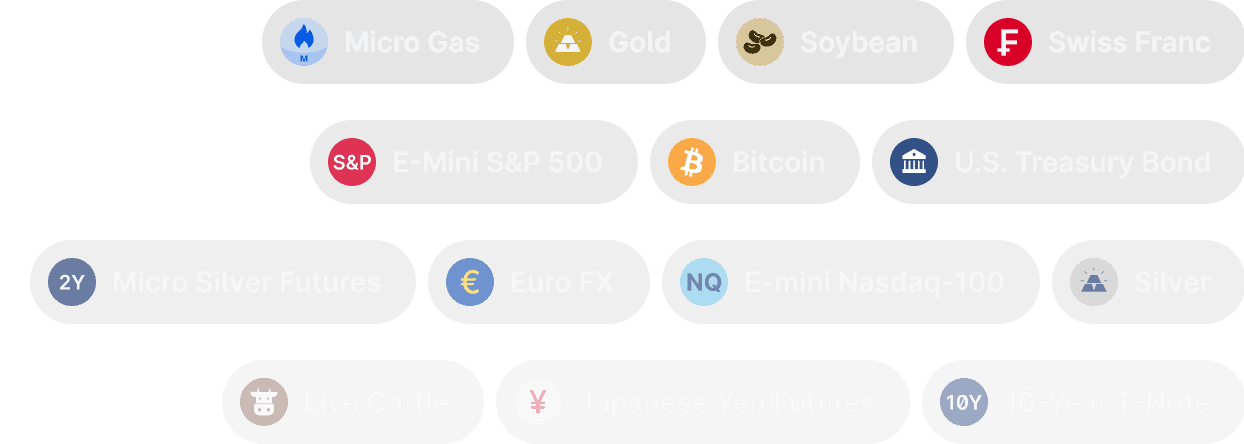

Futures

Trade the complete suite of CME-listed derivatives. Leverage execution algorithms and optimize your derivatives strategies.

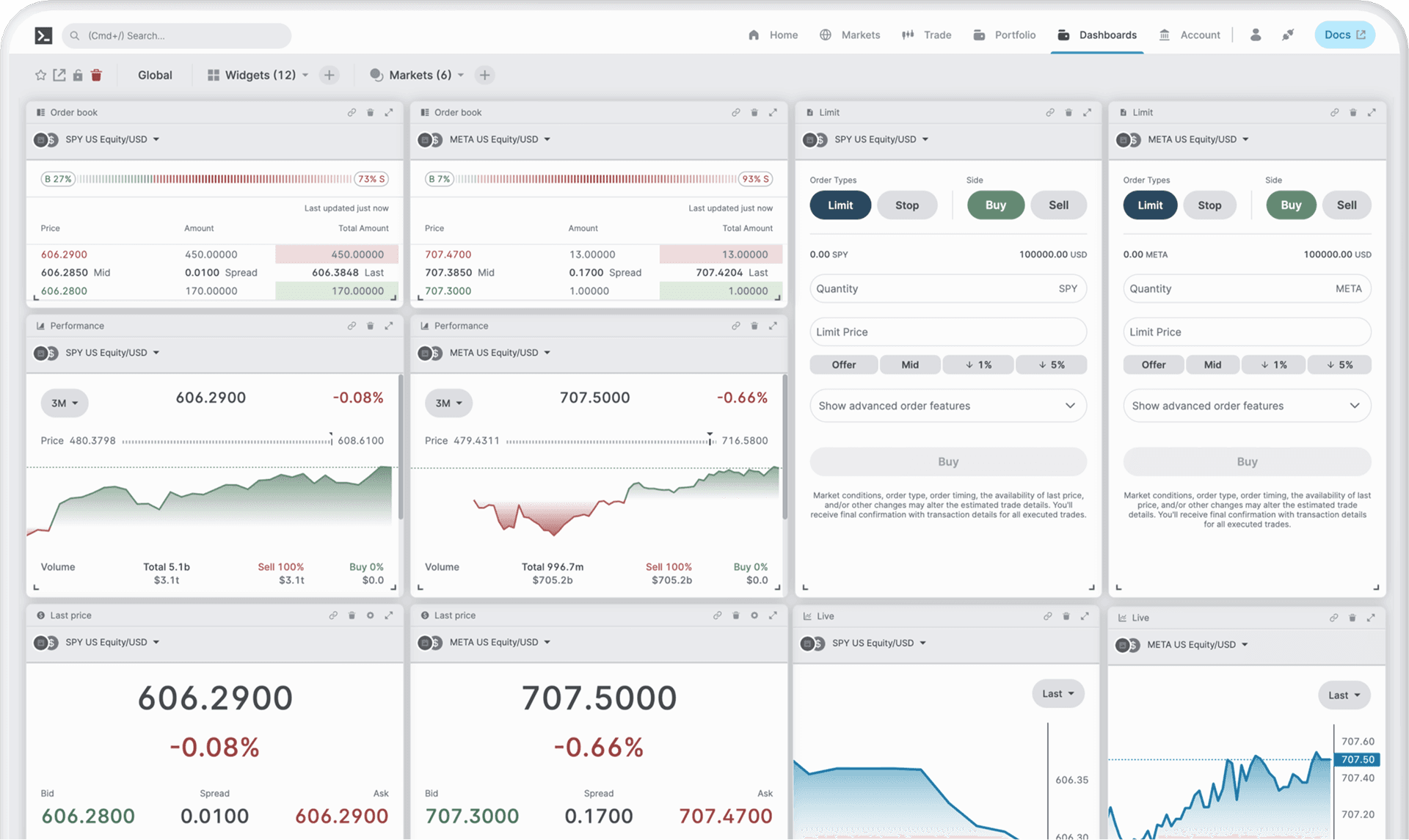

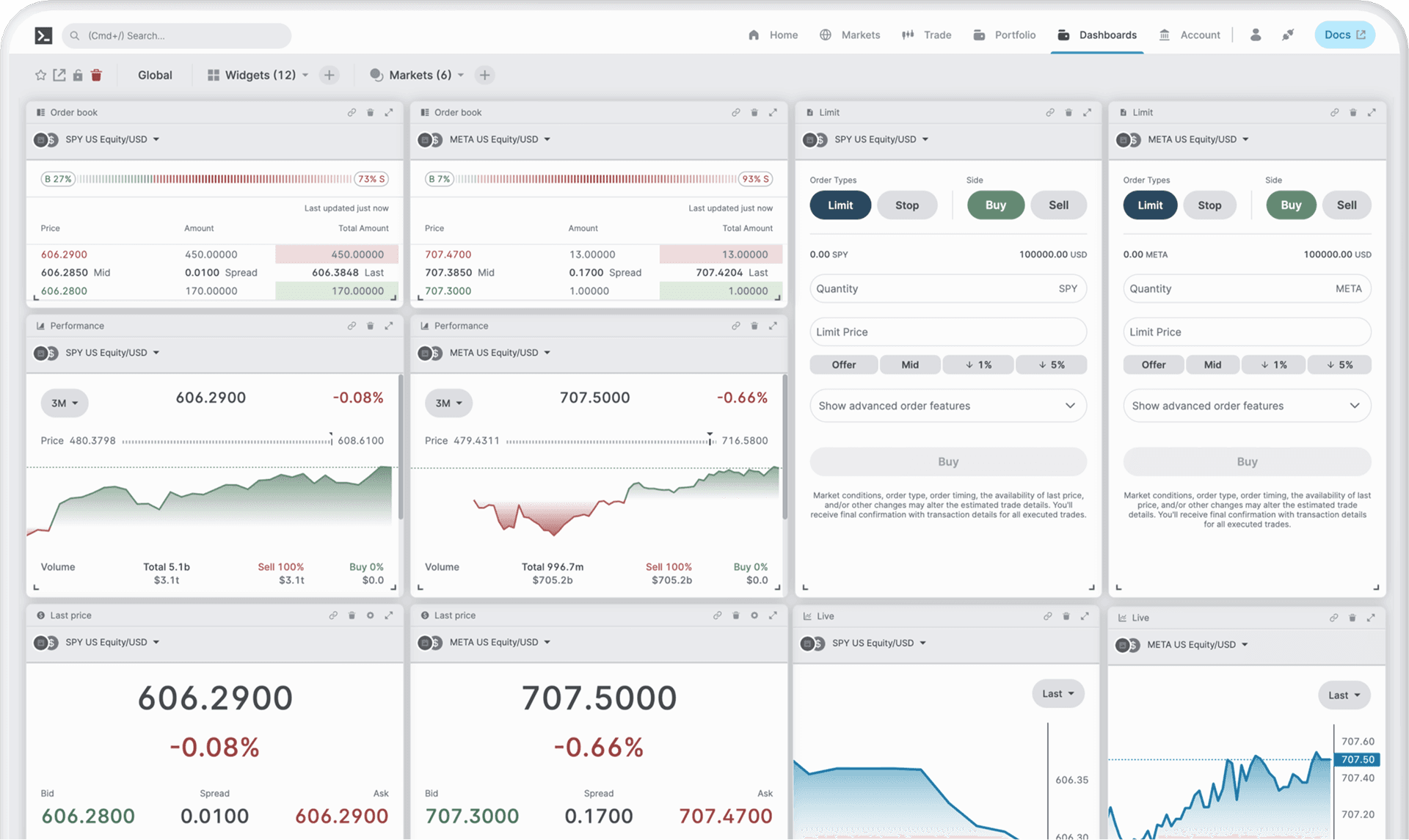

Dashboards

Quickly build dashboards that fit your trading style and strategy, choose from a library of widgets and select markets you trade.

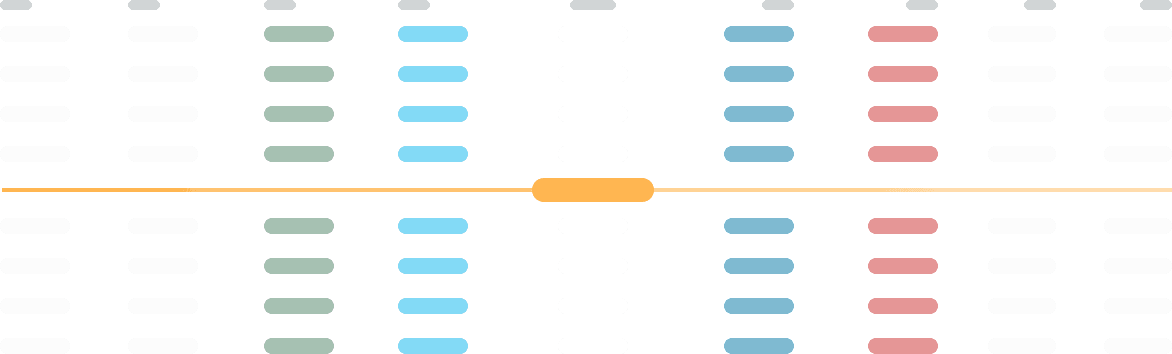

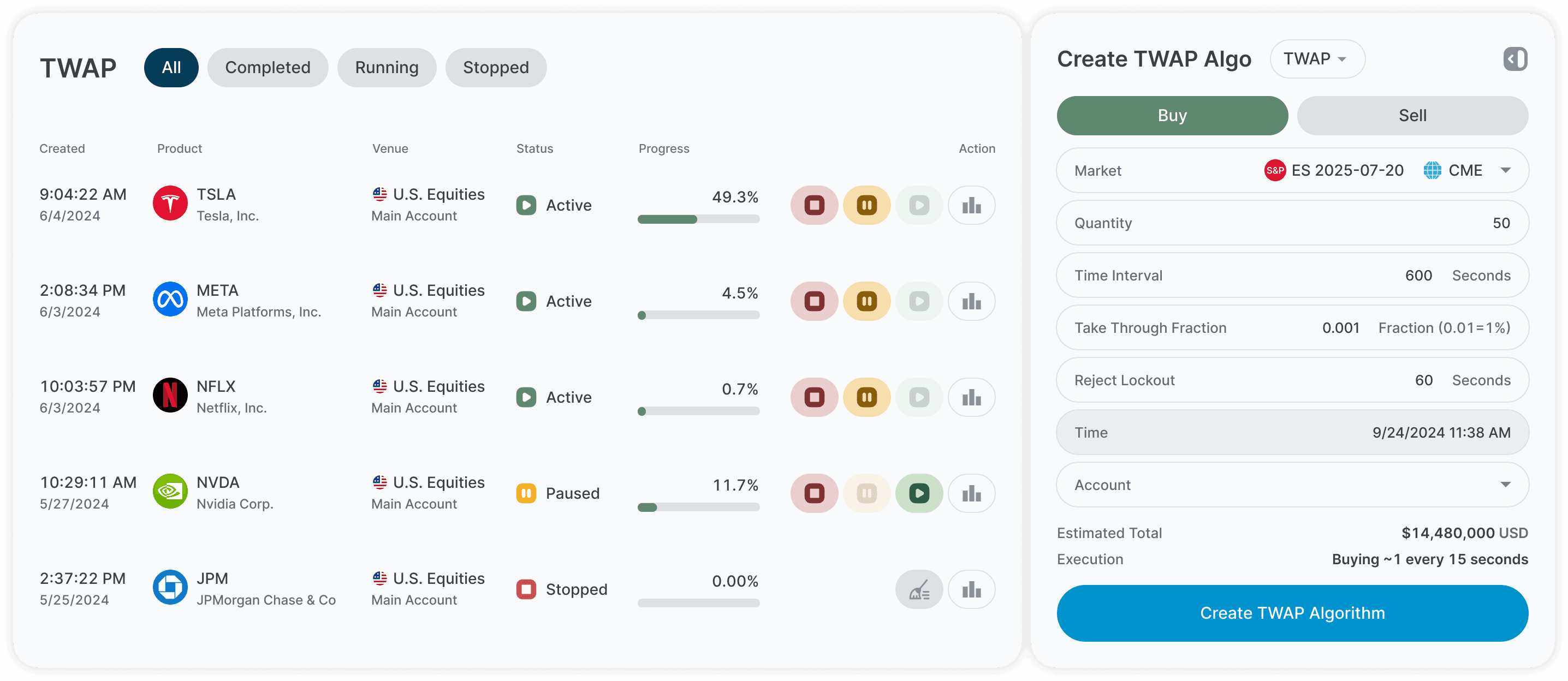

Algos

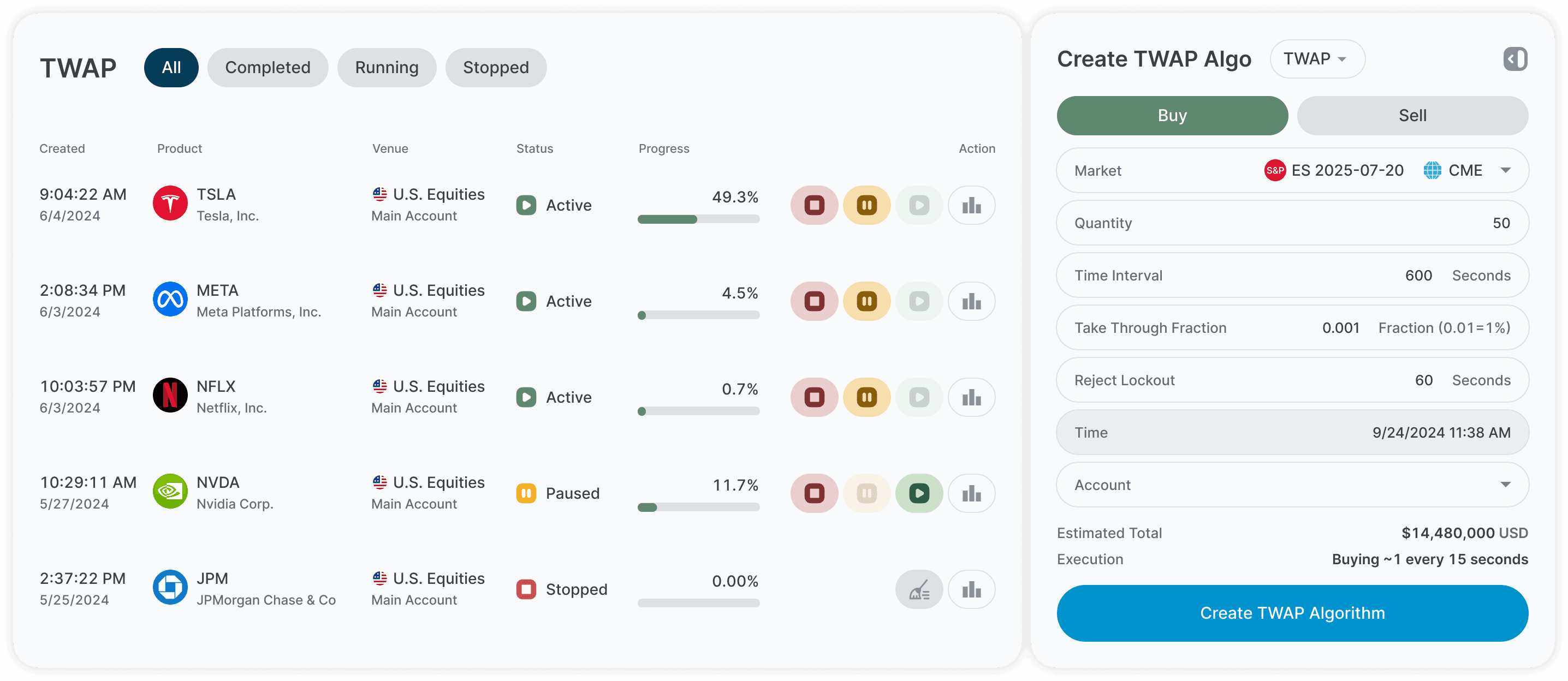

Built-in institutional-grade algos to achieve better execution quality. The Time-Weighted Average Price (TWAP) algo attempts to spread out an order evenly throughout a period of time. Using a TWAP execution is one way to achieve an average price that matches the market and can help minimize slippage and reduce costs.

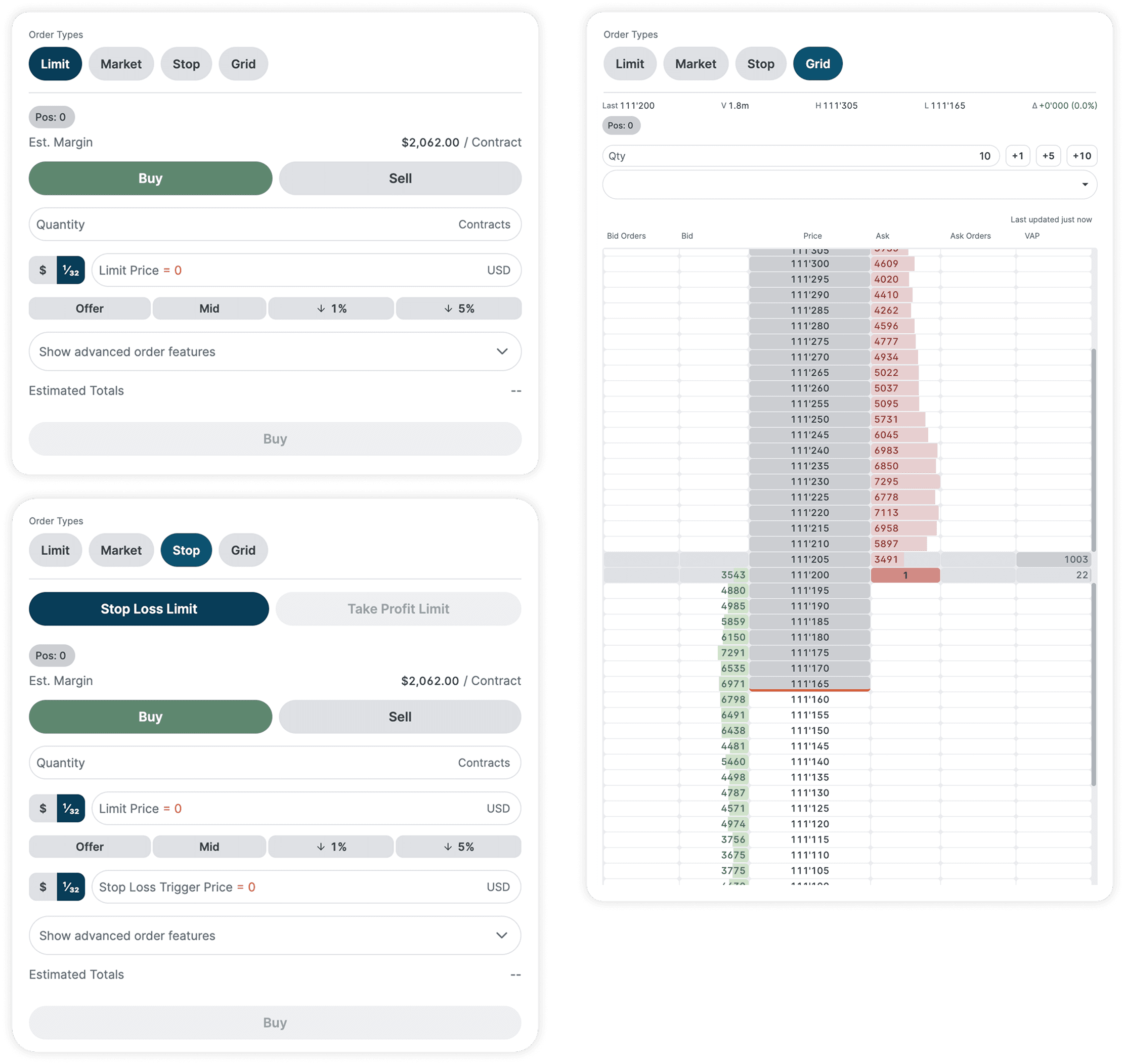

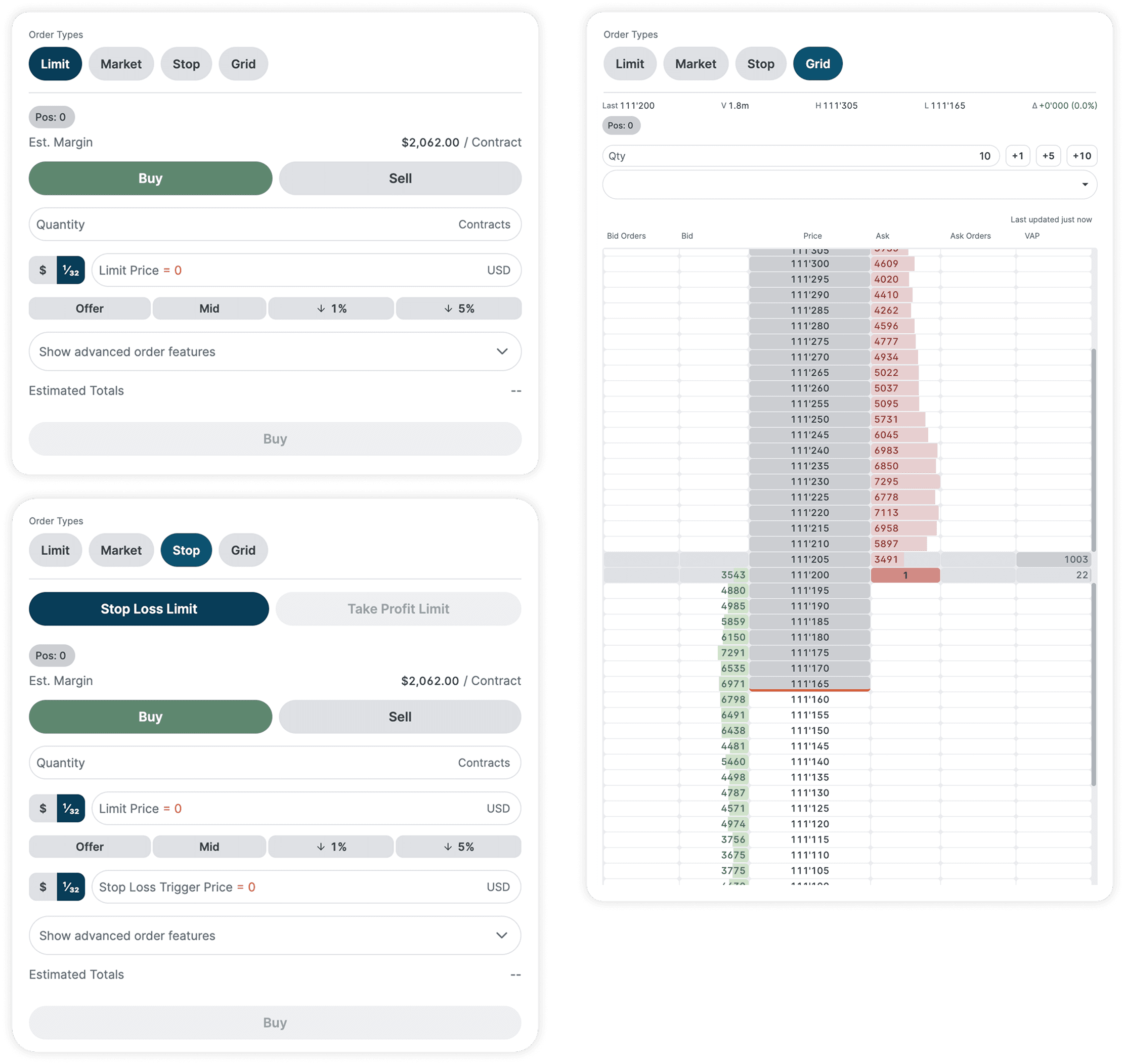

Order Types

Advanced Order Types: Use our Stop Loss and Take Profit order types to have more control over your trading strategies. Send orders quickly and efficiently using our Grid interface.

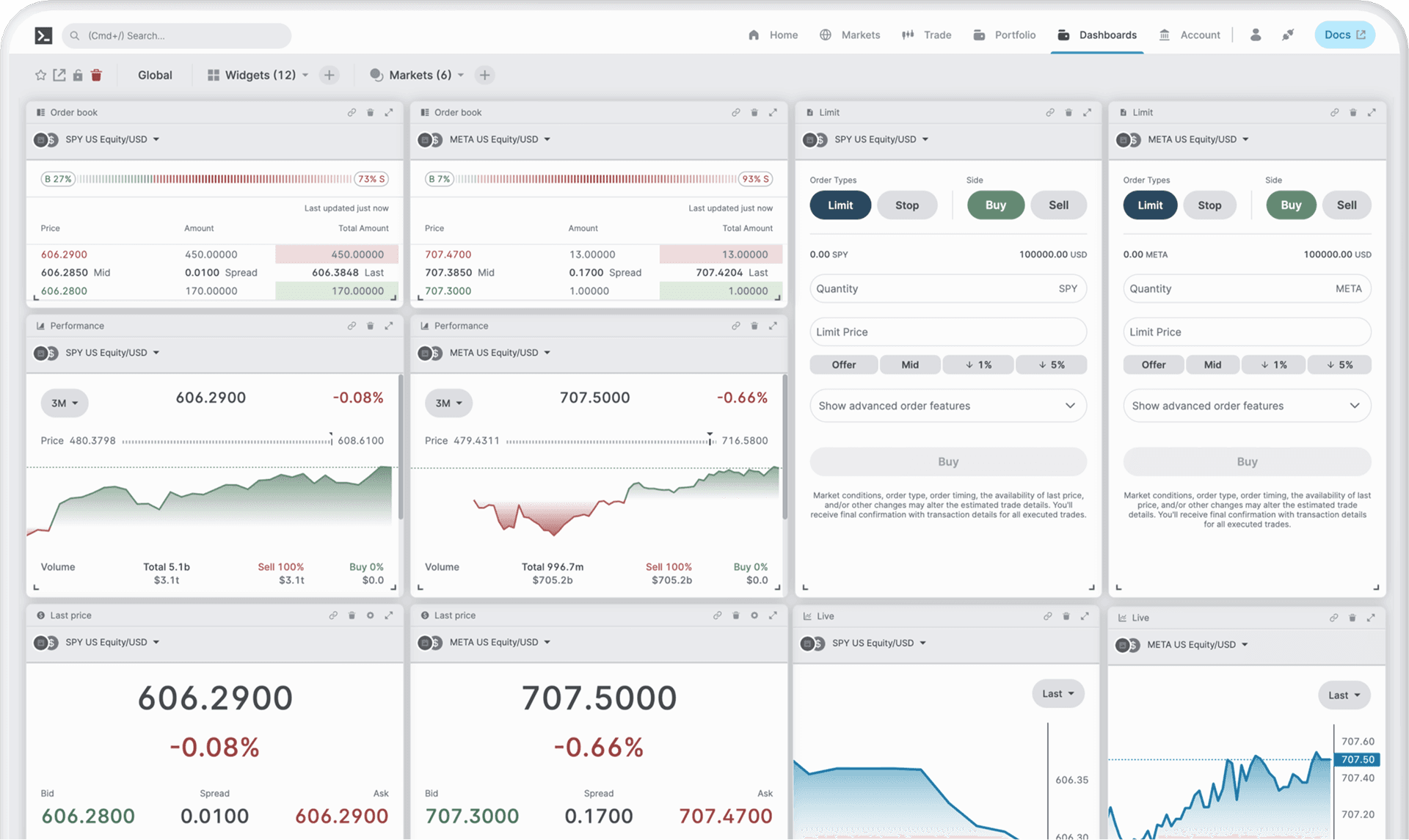

Dashboards

Quickly build dashboards that fit your trading style and strategy, choose from a library of widgets and select markets you trade.

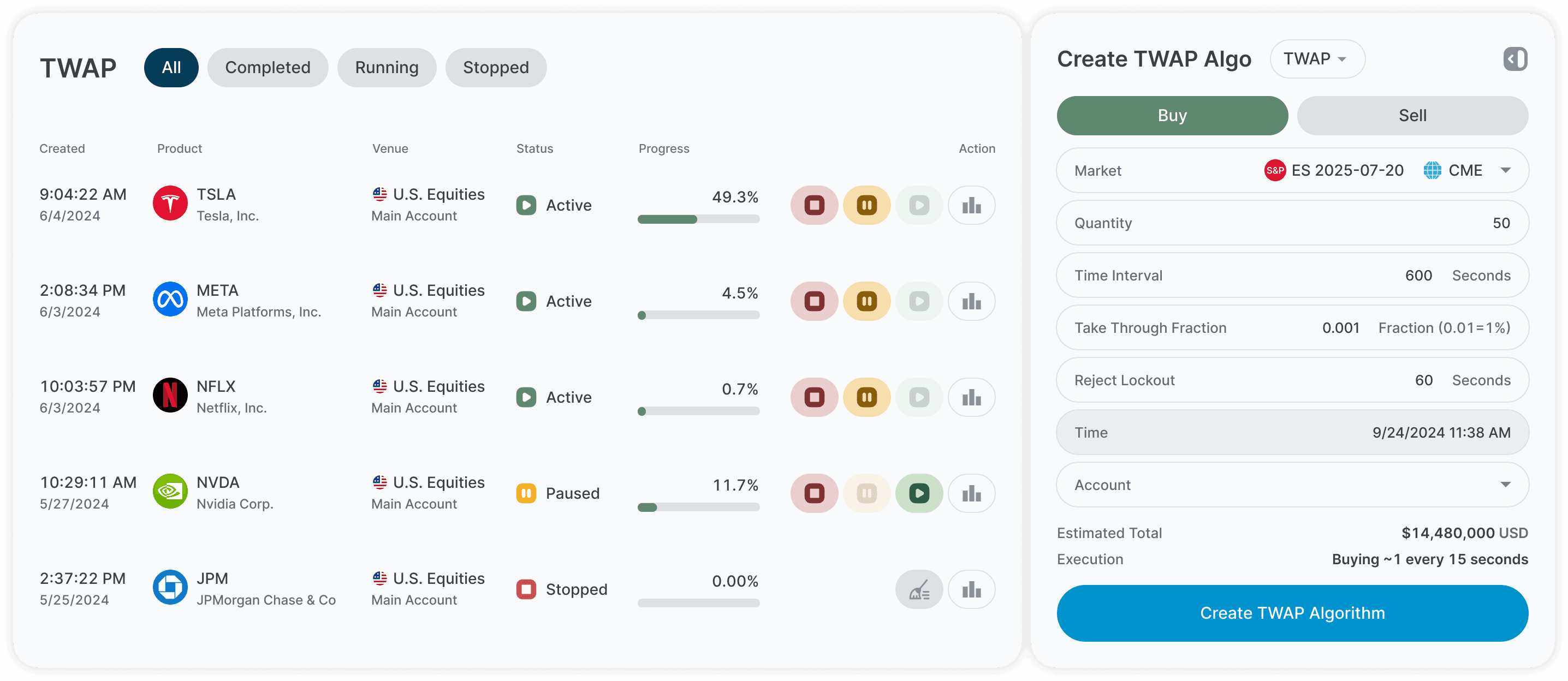

Algos

Built-in institutional-grade algos to achieve better execution quality. The Time-Weighted Average Price (TWAP) algo attempts to spread out an order evenly throughout a period of time. Using a TWAP execution is one way to achieve an average price that matches the market and can help minimize slippage and reduce costs.

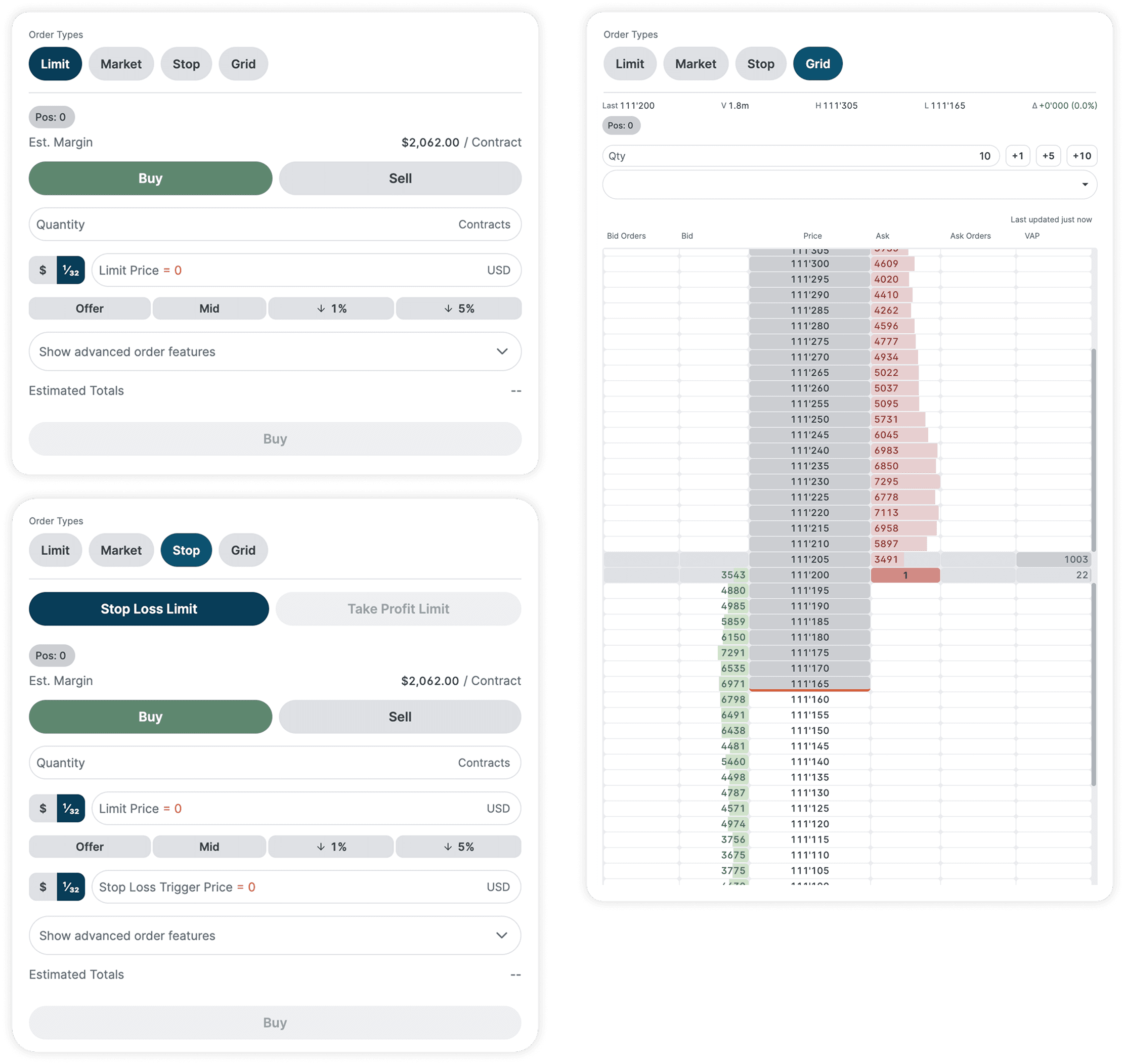

Order Types

Advanced Order Types: Use our Stop Loss and Take Profit order types to have more control over your trading strategies. Send orders quickly and efficiently using our Grid interface.

Order Types

Advanced Order Types: Use our Stop Loss and Take Profit order types to have more control over your trading strategies. Send orders quickly and efficiently using our Grid interface.

Algos

Built-in institutional-grade algos to achieve better execution quality. The Time-Weighted Average Price (TWAP) algo attempts to spread out an order evenly throughout a period of time. Using a TWAP execution is one way to achieve an average price that matches the market and can help minimize slippage and reduce costs.

Dashboards

Quickly build dashboards that fit your trading style and strategy, choose from a library of widgets and select markets you trade.

API

Multi-language API access

Multi-language API access

Multi-language API access

Develop execution algorithms, stream market data, access positions and P&L and more using our versatile, multi-language APIs.

Develop execution algorithms, stream market data, access positions and P&L and more using our versatile, multi-language APIs.

Rust

Python

JavaScript

Architect Financial Technologies Inc. is a software development company that owns and supports all proprietary technology used by Architect Financial Derivatives LLC, an NFA registered introducing broker (NFA # 0556853) providing brokerage services to traders of futures exchange products.

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Investors should understand the risks involved in trading and carefully consider whether such trading is suitable in light of their financial circumstances. Past performance is not necessarily indicative of future results. Margins are subject to change at anytime without notice. The trading of virtual currency futures and options carries additional risk. Prior to trading virtual currency futures and options, please view both the NFA and CFTC advisories providing more information on the potential risks. For additional information on the potential risks associated with futures and options trading please review the Risk Disclosure.

Architect Financial Derivatives LLC is a member of NFA and is subject to NFA's regulatory oversight and examinations; however, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets.

Securities trading and brokerage services are offered by Architect Securities LLC (“Architect Securities”). Architect Securities is registered as a broker-dealer with the U.S. Securities and Exchange Commission and is a member of the Financial Industry Regulatory Authority Inc. (“FINRA”). Brokerage accounts are held by, and orders are executed and settled by RQD* Clearing LLC. Architect Securities and RQD are both members of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash - more info at sipc.org).

With any investment, your capital is at risk. The value of your portfolio can go down as well as up. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Architect’s investment advisory services or Architect Securities’ brokerage services.

Online trading has inherent risk due to system response, execution price, speed, liquidity, market data and access times that may vary due to market conditions, system performance, market volatility, size and type of order and other factors. An investor should understand these and additional risks before trading.

Please refer to our Disclosures for more information about the derivatives and brokerage services and the features and functionalities of your accounts, specifically the Architect Derivatives Terms of Service and Risk Disclosures, and the Architect Securities Customer Agreement and Form CRS. By using this website, you accept the terms of the Architect Terms of Service and Privacy Policy.

Architect Financial Technologies Inc. is a software development company that owns and supports all proprietary technology used by Architect Financial Derivatives LLC, an NFA registered introducing broker (NFA # 0556853) providing brokerage services to traders of futures exchange products.

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Investors should understand the risks involved in trading and carefully consider whether such trading is suitable in light of their financial circumstances. Past performance is not necessarily indicative of future results. Margins are subject to change at anytime without notice. The trading of virtual currency futures and options carries additional risk. Prior to trading virtual currency futures and options, please view both the NFA and CFTC advisories providing more information on the potential risks. For additional information on the potential risks associated with futures and options trading please review the Risk Disclosure.

Architect Financial Derivatives LLC is a member of NFA and is subject to NFA's regulatory oversight and examinations; however, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets.

Securities trading and brokerage services are offered by Architect Securities LLC (“Architect Securities”). Architect Securities is registered as a broker-dealer with the U.S. Securities and Exchange Commission and is a member of the Financial Industry Regulatory Authority Inc. (“FINRA”). Brokerage accounts are held by, and orders are executed and settled by RQD* Clearing LLC. Architect Securities and RQD are both members of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash - more info at sipc.org).

With any investment, your capital is at risk. The value of your portfolio can go down as well as up. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Architect’s investment advisory services or Architect Securities’ brokerage services.

Online trading has inherent risk due to system response, execution price, speed, liquidity, market data and access times that may vary due to market conditions, system performance, market volatility, size and type of order and other factors. An investor should understand these and additional risks before trading.

Please refer to our Disclosures for more information about the derivatives and brokerage services and the features and functionalities of your accounts, specifically the Architect Derivatives Terms of Service and Risk Disclosures, and the Architect Securities Customer Agreement and Form CRS. By using this website, you accept the terms of the Architect Terms of Service and Privacy Policy.

© 2024 Architect Financial Technologies Inc. All Rights Reserved.